Private Equity List

Collaborate with AI to find the perfect PE/VC investors and secure funding together.

Visit

About Private Equity List

Private Equity List is a collaborative platform designed to democratize access to high-quality private equity and venture capital data. It serves as a powerful, user-friendly database for startups, consultants, fund managers, and researchers seeking to build meaningful connections within the investment ecosystem. The platform's core mission is to foster synergy between capital seekers and providers by offering a streamlined alternative to complex, expensive databases. With a focus on intuitive design and actionable intelligence, Private Equity List helps teams quickly identify and connect with the right investors, co-investors, or partners. Its recent integration of an AI-powered search function marks a significant leap forward, enabling users to find tailored investor lists through conversational queries. By combining human-curated, frequently updated data with a lightweight interface, the platform empowers a community of over 10,300 users to execute their fundraising, partnership, and research strategies more efficiently and effectively, together.

Features of Private Equity List

AI-Powered Search

This innovative feature allows you to find investors using natural language, making the search process collaborative and intuitive. Simply describe your project or ideal investor profile, and the AI will generate a targeted list. This teamwork between user input and AI analysis accelerates initial research, though results should be verified for accuracy to ensure a solid foundation for your outreach efforts.

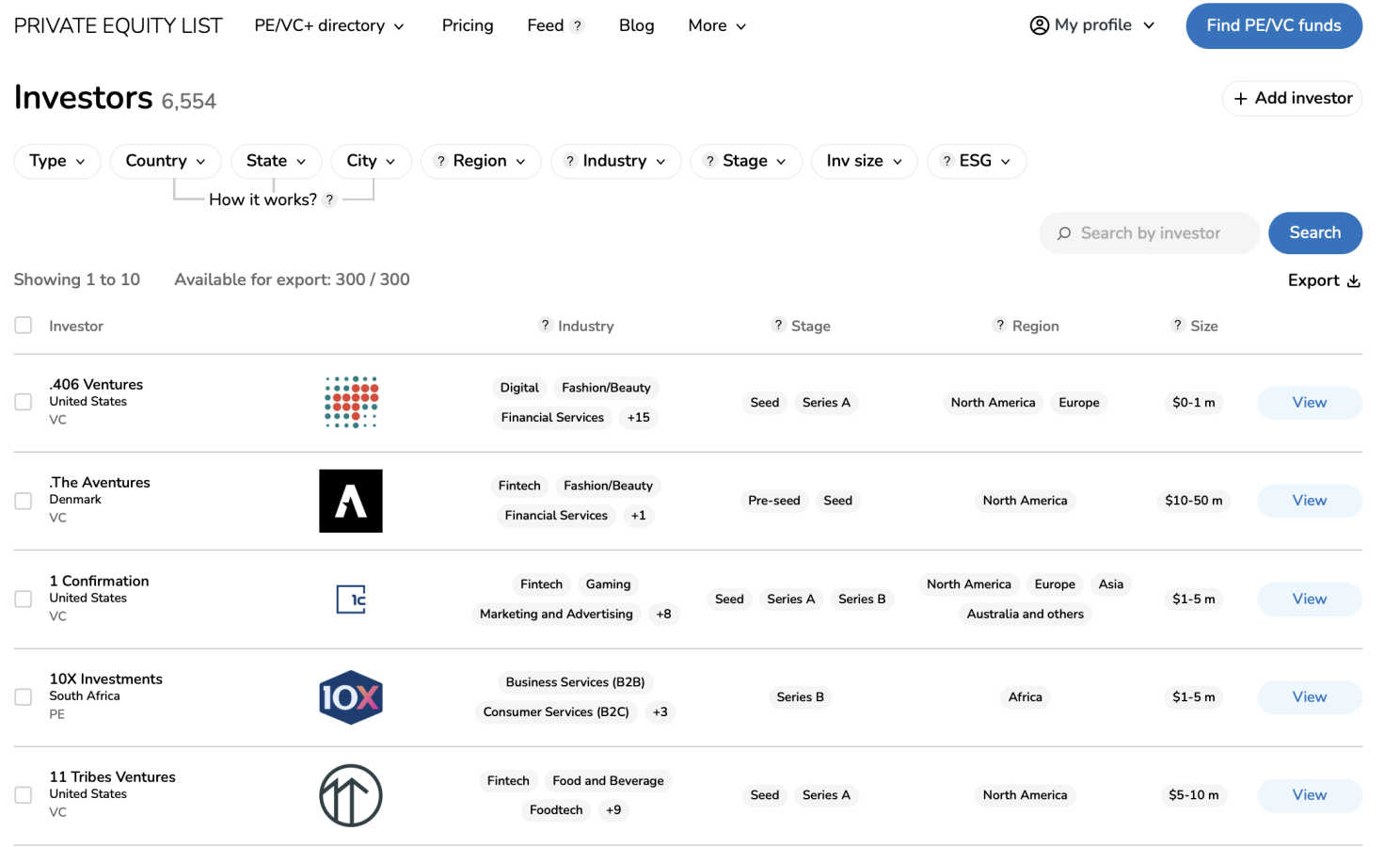

Super Intuitive Search & Filters

The platform offers a seamless, cooperative search experience with powerful, PE/VC-first filters. You can easily collaborate with your team to narrow down global investors by geography, investment stage, thesis, ticket size, and status. This ensures every team member is aligned and can quickly build a structured, relevant shortlist without the steep learning curve of other platforms.

Comprehensive Investor Profiles & Contacts

Each investor profile is a hub of collaborative intelligence, featuring detailed fund information, investment criteria, and, crucially, direct contacts for investment team members. With over 27,000 enriched contacts, this feature enables your team to move from research to direct engagement efficiently, fostering direct connections and partnership opportunities.

Export-Ready Data & Fresh Fund Listings

Facilitate teamwork with easy data export capabilities, allowing you to share structured lists with colleagues or clients instantly. Furthermore, the dedicated "New PE/VC" section highlights funds launched in the last 6-12 months, enabling your team to discover and partner with eager, new capital sources actively looking for deals.

Use Cases of Private Equity List

Startup Fundraising

Founders and startup teams can work together to rapidly identify and shortlist pre-seed to Series C investors that match their stage, geography, and vision. This collaborative filtering cuts down research time from weeks to minutes, allowing the team to focus on crafting a unified pitch and building synergistic relationships with potential investors.

Consultant & Advisor Mandates

Consultants and advisors can partner with their clients to create precise, tailored investor or buyer shortlists for fundraising and M&A mandates. The platform's export functionality allows for seamless sharing of data, enabling a cooperative workflow that helps close client success fees faster through targeted, strategic introductions.

VC Ecosystem Development

Venture capital funds, accelerators, and venture studios can use the database to find co-investors and strategic partners across a network of 6,000+ funds. This fosters a spirit of collaboration within the ecosystem, helping teams syndicate deals, share due diligence, and collectively support their portfolio companies' growth journeys.

Academic & Market Research

Universities, journalists, and government researchers can leverage the platform as a cooperative tool for market analysis, trend reporting, and economic studies. Access to a clean, structured dataset on global PE/VC activity supports collaborative research projects and provides reliable intelligence for public reporting and policy development.

Frequently Asked Questions

What makes Private Equity List different from Pitchbook or Crunchbase?

Private Equity List is built as a best-value, lightweight alternative focused specifically on the PE/VC search experience. It emphasizes a user-friendly interface, transparent and affordable pricing, and PE/VC-first filters without locking core functionality behind a high paywall or complex analytics overload, making it ideal for collaborative use by both small and large teams.

How accurate and current is the data?

The database is updated nearly daily and includes human-curated elements to ensure quality. While the AI search is a powerful tool for ideation, the platform advises users to verify specific details for accuracy. The "Only Active Funds" filter and the "New PE/VC" section help teams focus on the most current and relevant investment opportunities.

Is there a free plan available?

Yes, you can try the platform for free with basic functions and no credit card required. This allows teams to collaborate on initial searches and explore the interface together before committing to a paid plan, ensuring the tool fits their collective workflow.

What kind of information can I find in an investor profile?

Profiles are designed to facilitate connection. They typically include the fund's focus, stage preferences, geographic thesis, investment team details, and direct contact information. This comprehensive view supports your team's collaborative efforts to understand the investor's strategy and initiate a tailored, informed outreach.

You may also like:

Fieldtics

Fieldtics is an all-in-one platform for service businesses, streamlining scheduling, customer management, invoicing, and getting paid.

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

Tailride

AI-powered invoice and receipt automation from email and web portals