Pennyflo

About Pennyflo

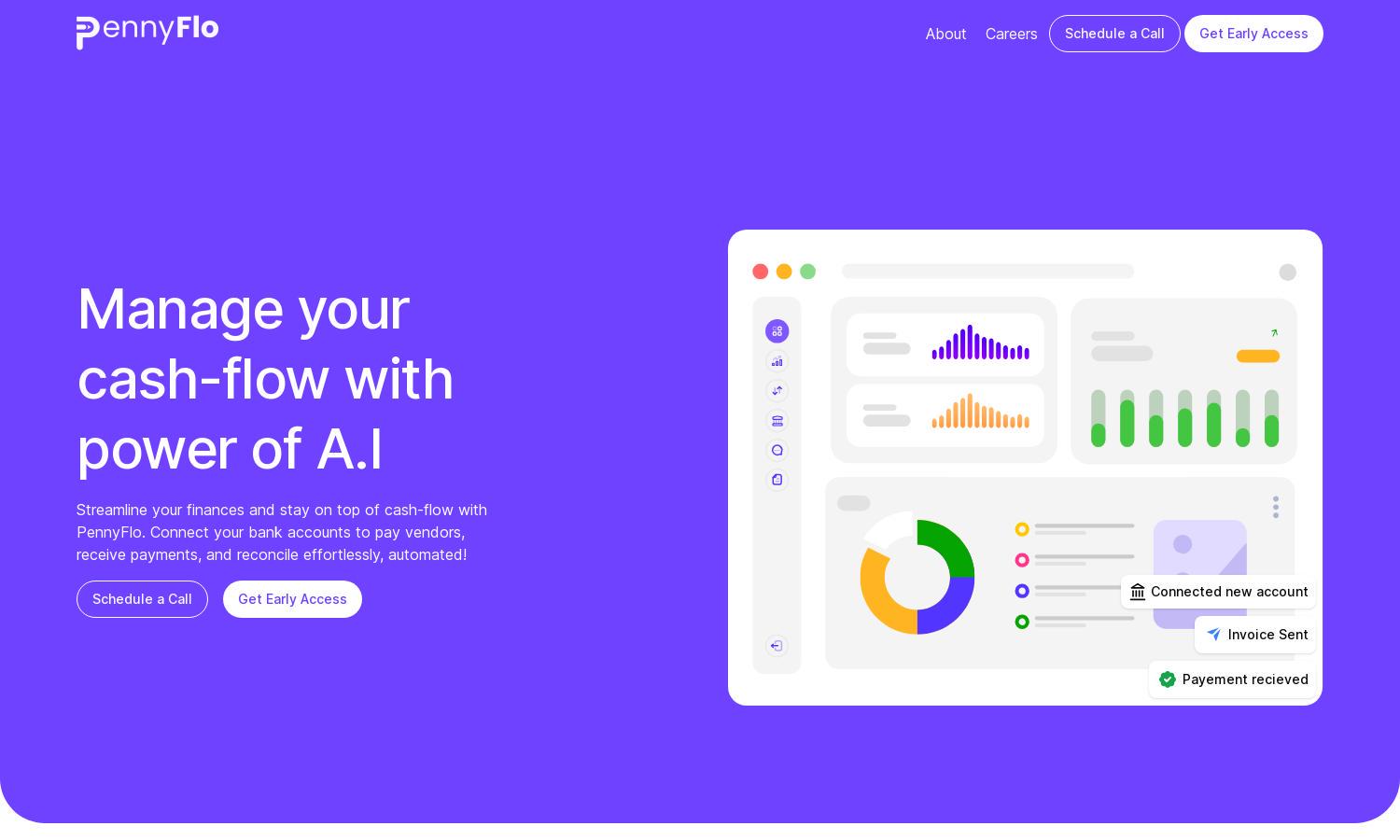

PennyFlo revolutionizes cash management for businesses by offering a unified, AI-powered platform that helps finance teams visualize cash flow in real-time. Users can automate workflows, generate comprehensive reports, and make informed decisions, significantly reducing cash shortage risks and enhancing financial management efficiency.

PennyFlo offers tiered pricing plans, ensuring access to diverse features tailored to business sizes and needs. Each subscription level delivers unique value, with enhanced functionality and support for users looking to optimize their cash flow management. Upgrading unlocks advanced tools to boost finance team efficiency.

PennyFlo features a user-friendly interface designed for seamless navigation and efficient cash management. Its clear layout and organized tools allow users to effortlessly track their financial data and access automated features, ensuring a smooth experience as they manage their cash flow and financial planning.

How Pennyflo works

To get started with PennyFlo, users undergo a straightforward onboarding process, wherein they connect their financial data and tools. Once set up, they can navigate through intuitive dashboards to view real-time cash flow, utilize automated banking features, and generate insightful reports, all while benefiting from AI-driven analysis tailored to their financial needs.

Key Features for Pennyflo

AI-powered cash flow visualization

PennyFlo's AI-powered cash flow visualization enables businesses to track their financial health in real-time. This unique feature helps users make data-driven decisions quickly, overcoming cash shortage risks and enhancing overall financial management, resulting in improved efficiency and profitability.

Automated banking and reconciliations

PennyFlo offers automated banking and reconciliation features that streamline financial operations for businesses. This significant capability reduces manual workload, enhances accuracy, and saves time, empowering finance teams to focus on strategic tasks rather than repetitive data entry, ultimately improving cash management efficiency.

Dynamic forecasting tools

PennyFlo's dynamic forecasting tools utilize historical data to predict future cash flow scenarios. This feature enables businesses to plan effectively, prepare for potential cash shortages, and make informed financial decisions, enhancing strategic planning and ultimately leading to greater financial stability.

You may also like: