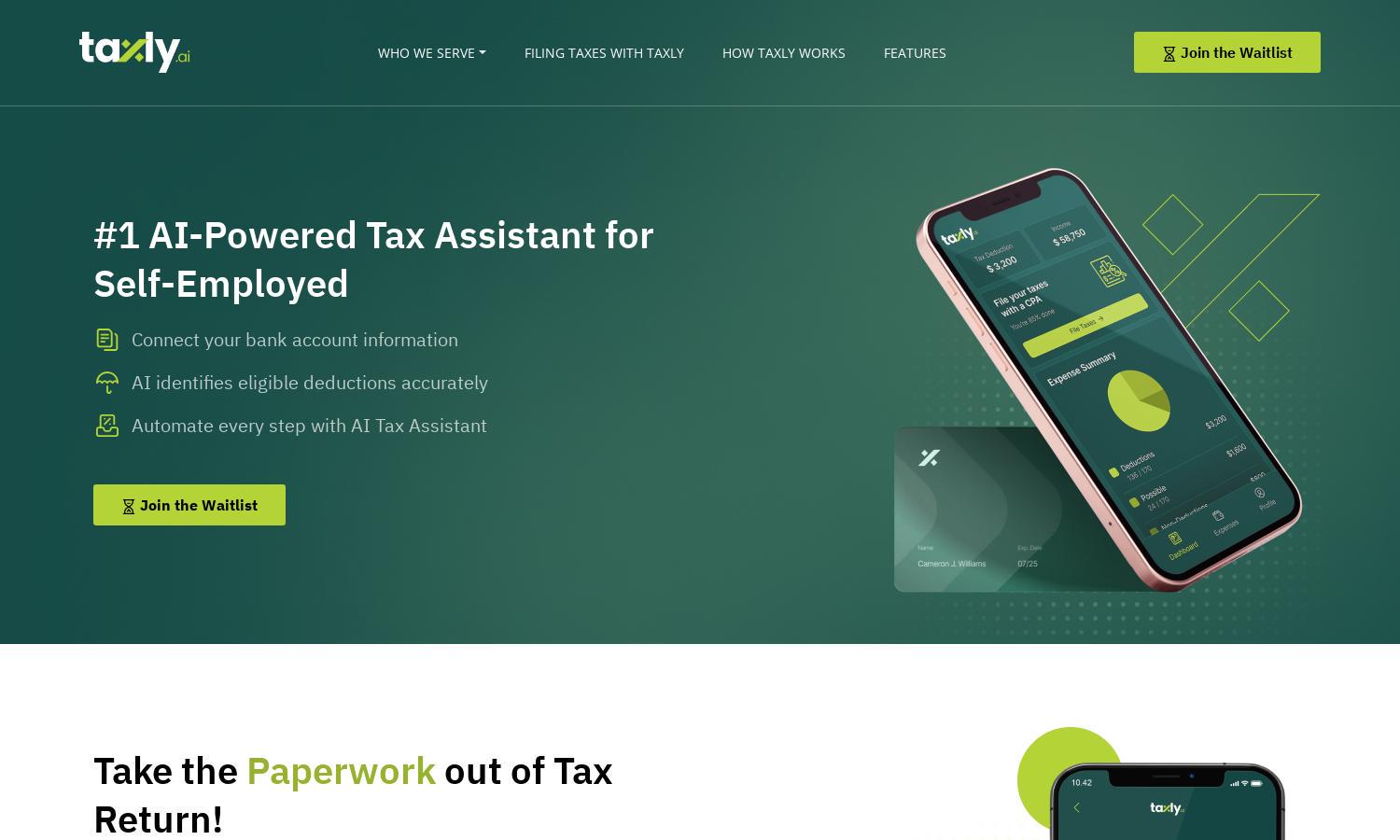

Taxly.ai

About Taxly.ai

Taxly.ai is an innovative platform designed for freelancers and self-employed professionals. It leverages AI technology to streamline tax filing by automatically scanning for deductions and facilitating real-time expense tracking. Users benefit from expert CPA consultations, ensuring accurate tax reporting and maximizing savings for a stress-free tax season.

Taxly.ai offers users flexible pricing tiers, catering to various needs. Starting with a basic plan that includes essential features, users can opt for premium subscriptions, unlocking advanced functionalities and personalized CPA support. Upgrading enhances the user experience with tailored advice and additional reporting options, maximizing financial efficiency.

Taxly.ai features a user-friendly interface that simplifies tax management for self-employed individuals. The intuitive design allows seamless navigation, with sections for tracking expenses and managing records. Unique features, such as automated categorization and real-time insights, ensure users have a smooth experience throughout the tax filing process.

How Taxly.ai works

Users start by signing up on Taxly.ai and connecting their transaction records for a comprehensive overview. The AI analyzes their financial data, automatically categorizing eligible deductions and providing personalized recommendations. Users can then manage their tax records, consult expert CPAs within the app, and file taxes securely, ensuring a streamlined experience.

Key Features for Taxly.ai

AI-Powered Deduction Scanning

Taxly.ai features an advanced AI-powered deduction scanning capability that identifies eligible tax deductions for users. This unique functionality streamlines the tax filing process by ensuring that freelancers never miss potential savings, ultimately maximizing their tax efficiency and minimizing liabilities.

Expert CPA Support

Taxly.ai offers expert CPA support, providing users with access to certified tax professionals. This key feature enhances the platform’s usability, allowing for personalized consultations, real-time advice, and accurate tax filing assistance, helping users navigate complex tax regulations confidently.

Automated Expense Tracking

Automated expense tracking is a standout feature of Taxly.ai, allowing users to connect their accounts and categorize expenses effortlessly. This function improves accuracy in expense reporting, ensuring freelancers can easily access financial insights and optimize their tax deductions, making tax time less stressful.