Skwad

About Skwad

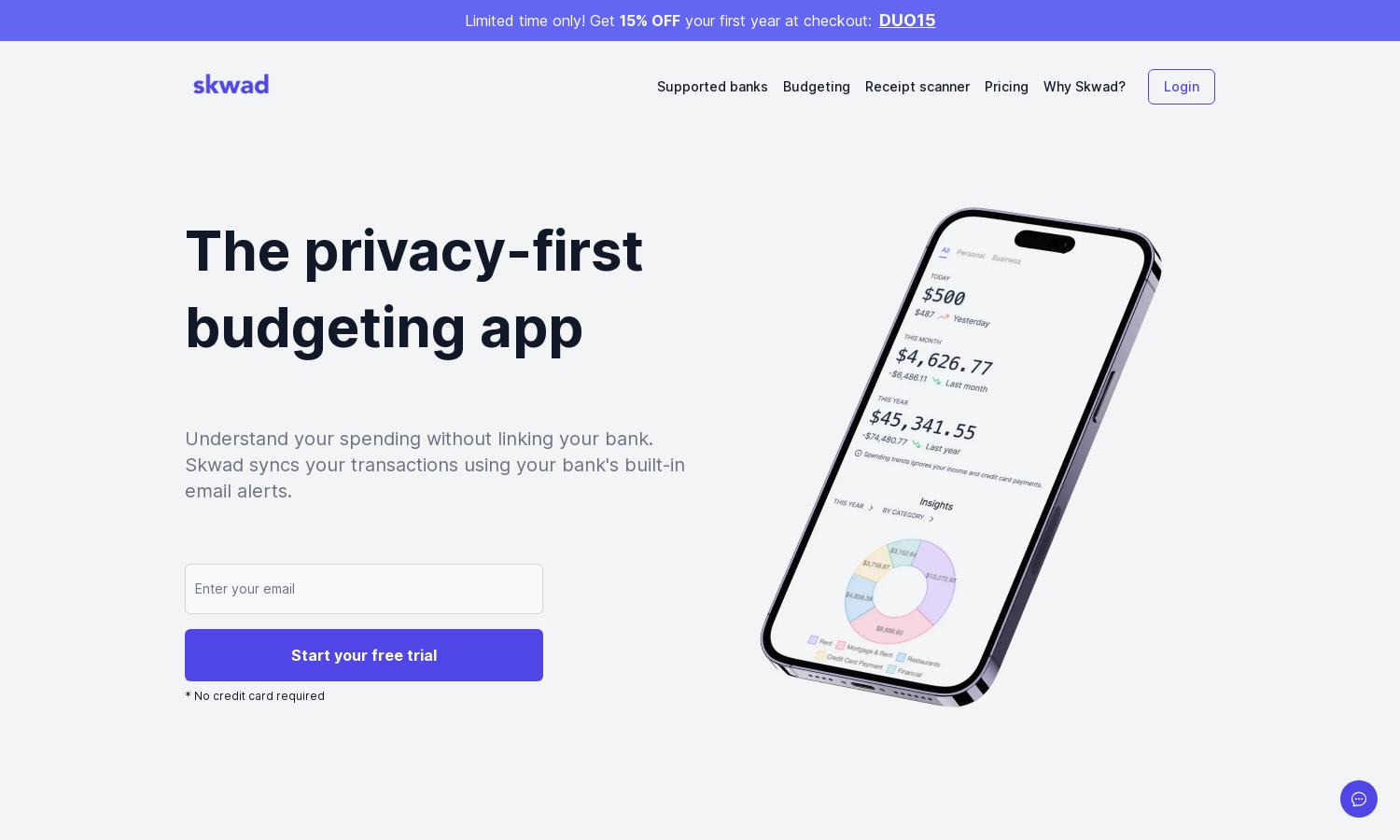

Skwad is a revolutionary budgeting app designed for users who value privacy and security. It helps individuals effortlessly track their spending and income by utilizing built-in bank email alerts instead of requiring sensitive bank login information, making financial management easy and secure.

Skwad offers flexible subscription plans catering to different user needs. These plans ensure users access essential budgeting features while providing a special discount of 15% off the first year with code DUO15. By upgrading, users can unlock enhanced functionalities for seamless financial tracking.

Skwad features a user-friendly interface that provides a seamless experience for budgeting. Its expertly designed layout allows users to easily navigate through various features like transaction categorization and analytics, ensuring a smooth journey while managing finances efficiently and effectively.

How Skwad works

To get started with Skwad, users sign up for a dedicated scan email address. They can then set up automated bank alerts that forward transaction notifications to Skwad. The app swiftly categorizes these alerts into transactions, offering real-time insights into spending without compromising privacy.

Key Features for Skwad

Instant Transaction Sync

Skwad's Instant Transaction Sync feature allows users to receive real-time updates on their finances. By leveraging bank email alerts, Skwad ensures users access their latest transactions immediately, making budgeting and expense tracking straightforward, secure, and hassle-free.

Privacy-Focused Budgeting

Skwad emphasizes privacy-focused budgeting by never requiring users to share sensitive bank details. Users can manage their finances securely, knowing that their login information remains confidential while still benefiting from robust transaction tracking and categorization.

Customizable Categories

Skwad offers fully customizable categories for managing expenses. This feature enables users to break down transactions into meaningful groups, enhancing financial visibility and allowing for tailored tracking based on individual unique spending habits and preferences.