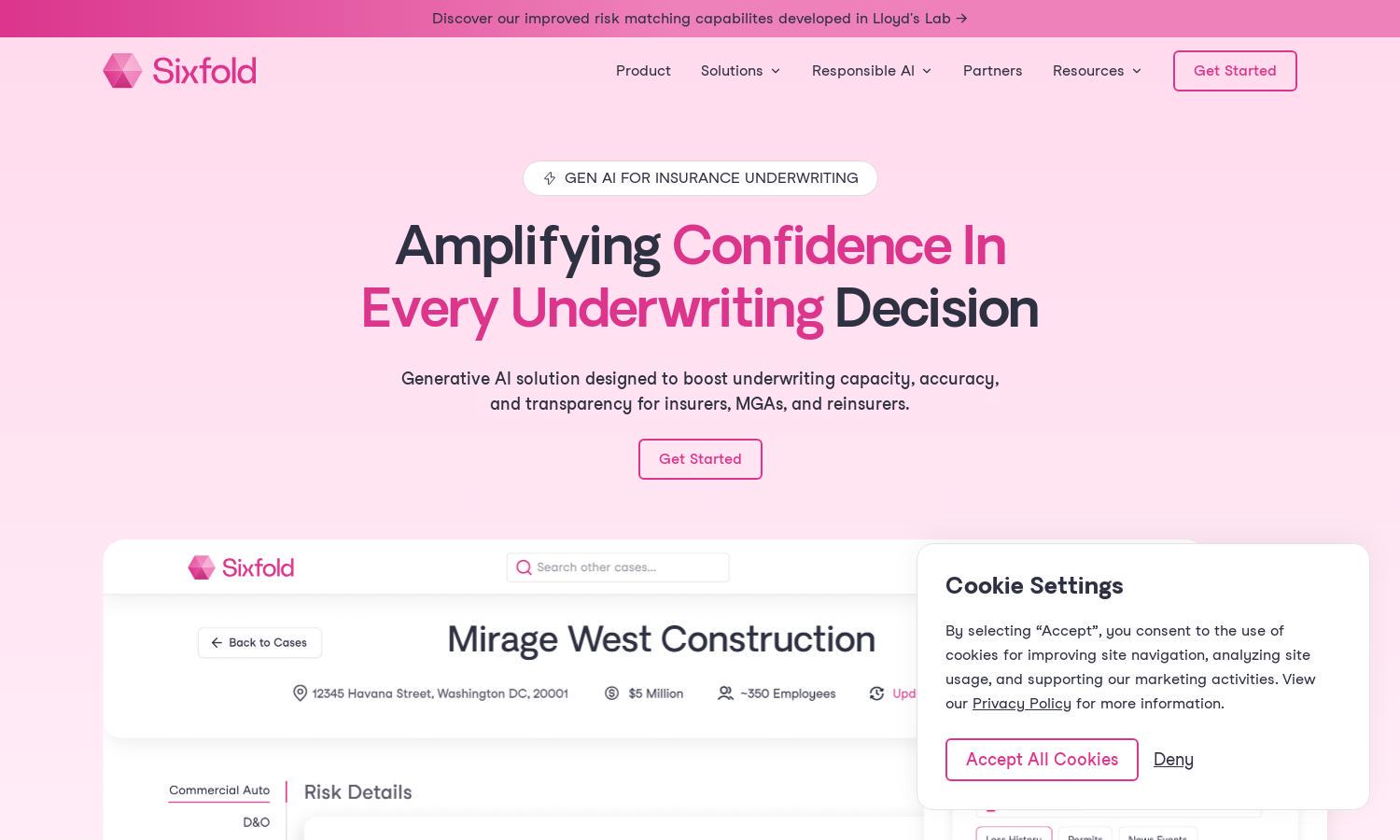

Sixfold

About Sixfold

Sixfold transforms insurance underwriting through innovative generative AI tools tailored for insurance professionals. By automating tedious tasks and offering tailored risk assessments, it enhances underwriting efficiency and accuracy. Users can easily integrate Sixfold into their workflow, addressing the complexities of risk management and decision-making.

Sixfold offers flexible pricing plans catering to various underwriting needs. Subscriptions range from basic access to advanced features with competitive rates. Users can benefit from special discounts on annual plans, enabling them to harness the full potential of AI-driven risk insights for their insurance operations.

Sixfold features a user-friendly interface that simplifies navigation and enhances the browsing experience. With intuitive layouts and easy access to tools, users can efficiently manage underwriting processes. Key functionalities are strategically placed to facilitate smooth interactions, ensuring a seamless experience throughout the platform.

How Sixfold works

Users start by onboarding with Sixfold, where they can input their underwriting guidelines. The platform ingests this data, analyzes submissions, and extracts risk information, providing tailored recommendations through a clear, intuitive interface. Its generative AI capabilities streamline workflows, making it easy for underwriters to navigate complex datasets and make informed decisions.

Key Features for Sixfold

Automated Risk Assessment

Sixfold's automated risk assessment feature revolutionizes underwriting by ingesting guidelines and submissions, streamlining the identification of risk factors. This advanced capability allows underwriters to make informed decisions rapidly, enhancing efficiency and accuracy in the underwriting process, a testament to Sixfold's cutting-edge technology.

Transparent Decision-Making

Transparency in decision-making is a cornerstone of Sixfold. The platform offers full traceability for all underwriting decisions, ensuring compliance and clear justification of actions. This unique aspect fosters trust among users and stakeholders, enhancing confidence in the underwriting process and results.

Seamless Integration

Sixfold seamlessly integrates with existing insurance technologies, allowing insurers to leverage its capabilities without overhauling legacy systems. This distinct feature enables users to enhance their workflow efficiently, maximizing productivity without disrupting their established processes, thus making adoption hassle-free.