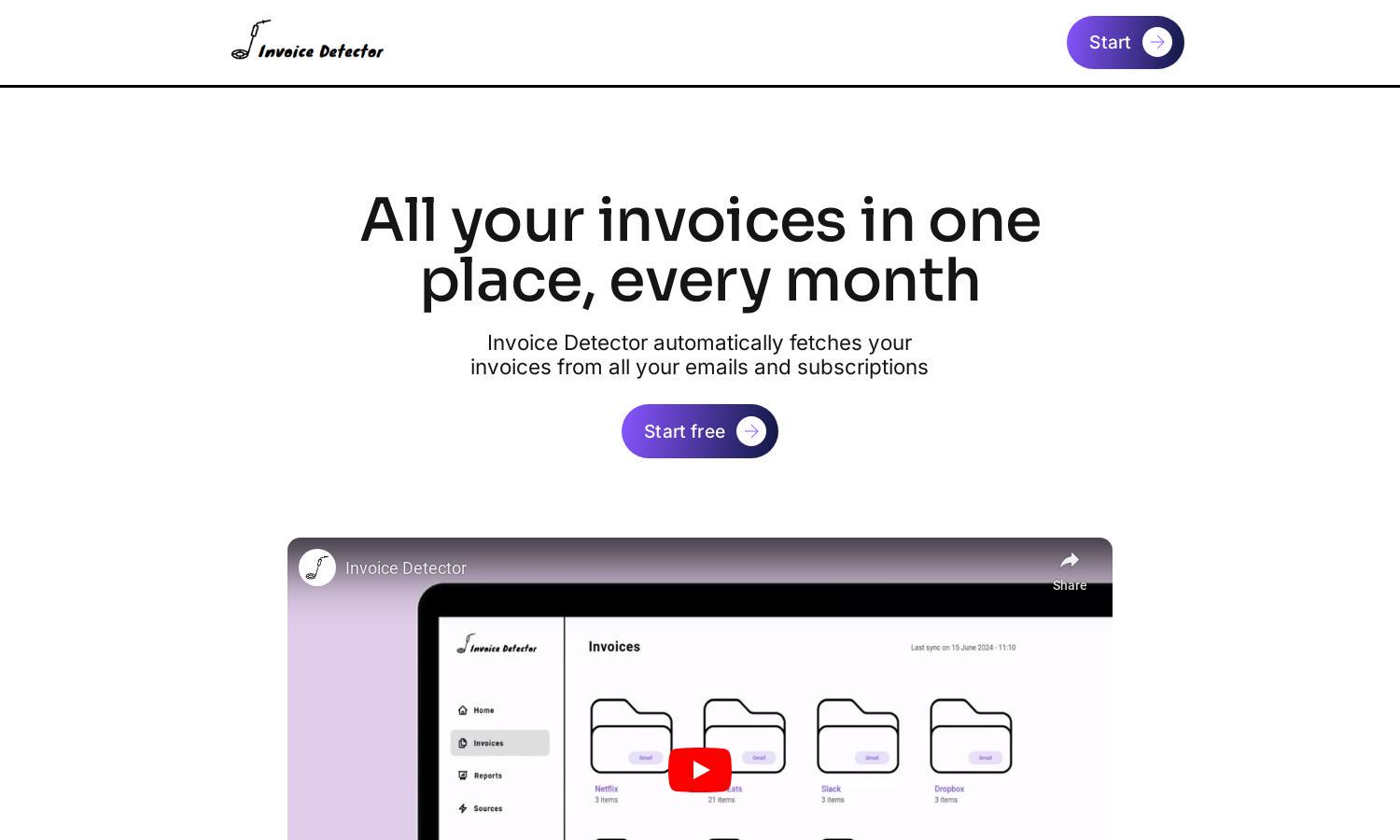

Invoice Detector

About Invoice Detector

Invoice Detector transforms accounting with its innovative AI that automates data extraction from invoices and related documents. Designed for accounting and bookkeeping firms, it frees up professionals' time, allowing them to focus on higher-value tasks. Experience seamless integration and efficient workflows with Invoice Detector.

Invoice Detector offers flexible pricing plans tailored for different business sizes. The Business plan is ideal for small firms at €450 per month for up to 1,000 invoices. The Enterprise plan is customizable for larger firms with no cap on invoices, ensuring scalable solutions for every user.

The user interface of Invoice Detector is intentionally designed for simplicity and efficiency, offering a clean layout that enhances navigation. With user-friendly features like automatic document categorization and data extraction, Invoice Detector ensures a seamless experience for accountants and bookkeepers in managing their workflows.

How Invoice Detector works

Users begin by signing up for Invoice Detector and can easily onboard by uploading their financial documents. The platform uses AI to automatically extract key information like supplier details and expense line items, validating and categorizing each document. Users can then send the organized data to their preferred accounting software, allowing for streamlined bookkeeping processes.

Key Features for Invoice Detector

Automated Data Extraction

Invoice Detector's automated data extraction feature uniquely enhances the bookkeeping process, allowing firms to capture essential financial details from invoices without manual entry. By leveraging sophisticated AI technology, Invoice Detector ensures accuracy and efficiency, ultimately saving time and reducing human error in financial management.

Auto Document Categorization

Invoice Detector excels in auto document categorization, making it effortless for accounting firms to manage various financial documents. This feature not only saves time but also ensures that all documents are accurately verified and organized, providing users with a clear and streamlined workflow for effective bookkeeping.

Seamless Software Integration

Invoice Detector offers seamless integration with major accounting software providers, streamlining the transfer of financial data for users. This key feature enhances productivity by ensuring that all document data is quickly and easily sent to the tools users already utilize, eliminating the need for manual entry and reducing errors.

You may also like: