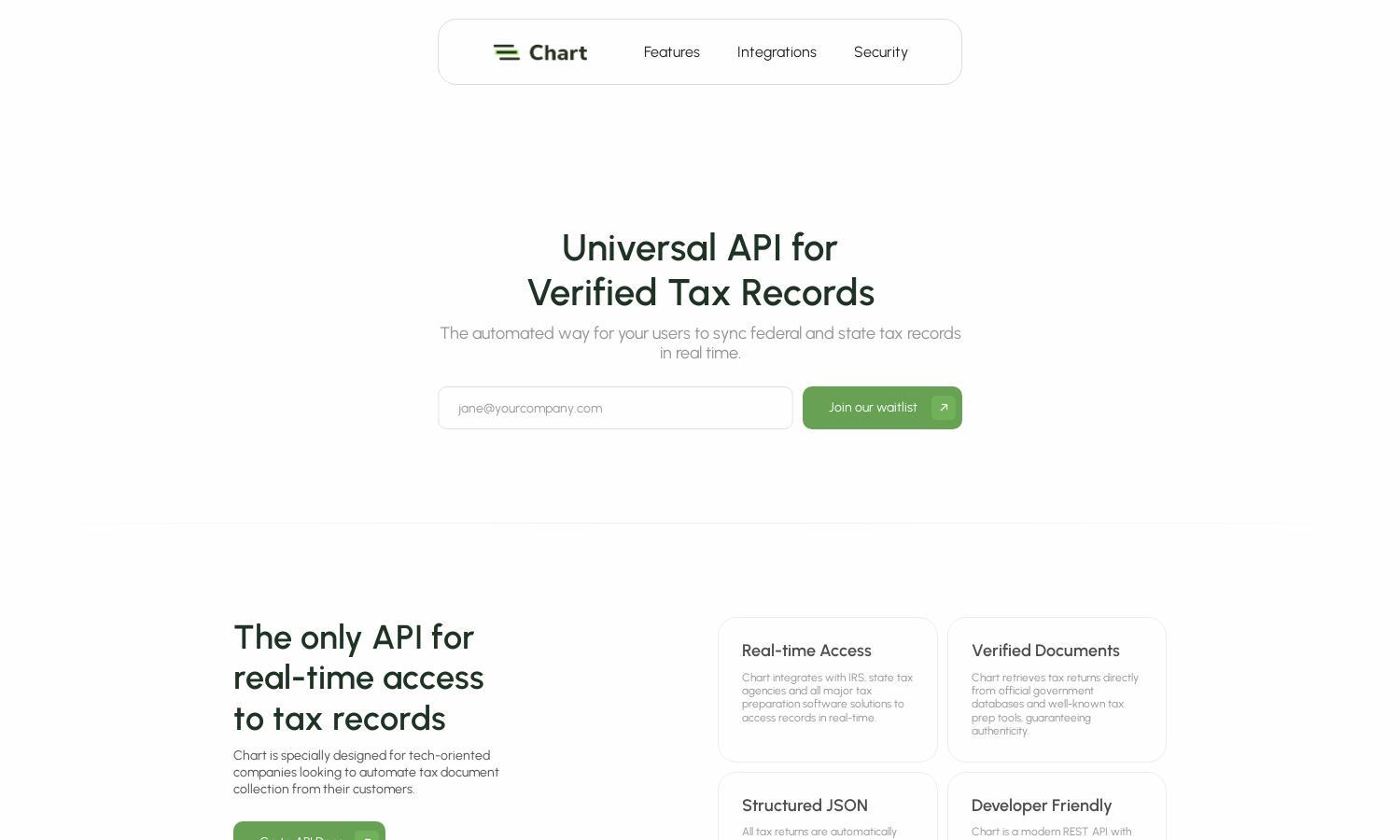

Chart

About Chart

Chart is a universal API designed for tech-oriented companies that need to automate tax document collection. By integrating with IRS and state tax agencies, Chart allows users to access verified tax records in real time, ensuring authenticity and enhancing the efficiency of tax processes.

Chart offers flexible pricing plans tailored to businesses of all sizes. Each tier provides significant value, with options for increased access and features. Upgrading unlocks advanced functionalities that streamline tax record retrieval and processing, making Chart an indispensable tool for developers and financial firms.

Chart features a user-friendly interface that ensures a seamless experience for navigating tax records. Its intuitive layout, combined with easy access to essential tools, enhances efficiency. By prioritizing user experience, Chart empowers users to effortlessly retrieve and manage verified tax records in real time.

How Chart works

Users begin by onboarding with Chart, creating an account to access the API. After setup, they can navigate a streamlined dashboard that provides real-time access to verified tax records. By linking IRS accounts, uploading PDFs, or using tax prep software, users easily collect necessary documents while enjoying automated features.

Key Features for Chart

Real-time Tax Record Access

Chart offers real-time access to verified tax records, allowing users to seamlessly retrieve essential documents. This innovative feature streamlines tax document collection, ensuring authenticity and enhancing compliance for tech-oriented companies leveraging Chart’s capabilities for efficient data management.

Verified Document Retrieval

The verified document retrieval feature of Chart guarantees authenticity by sourcing tax returns from official databases and reputable tax prep tools. This added trust empowers users to confidently manage their tax documentation, ensuring accuracy and compliance, making Chart a vital resource for developers and finance professionals.

Developer-Friendly Integrations

Chart stands out with its developer-friendly integrations, providing REST API functionality and SDK support in major programming languages. This ensures a smooth implementation experience for tech teams, allowing businesses to easily leverage Chart's powerful capabilities in their existing systems and applications.