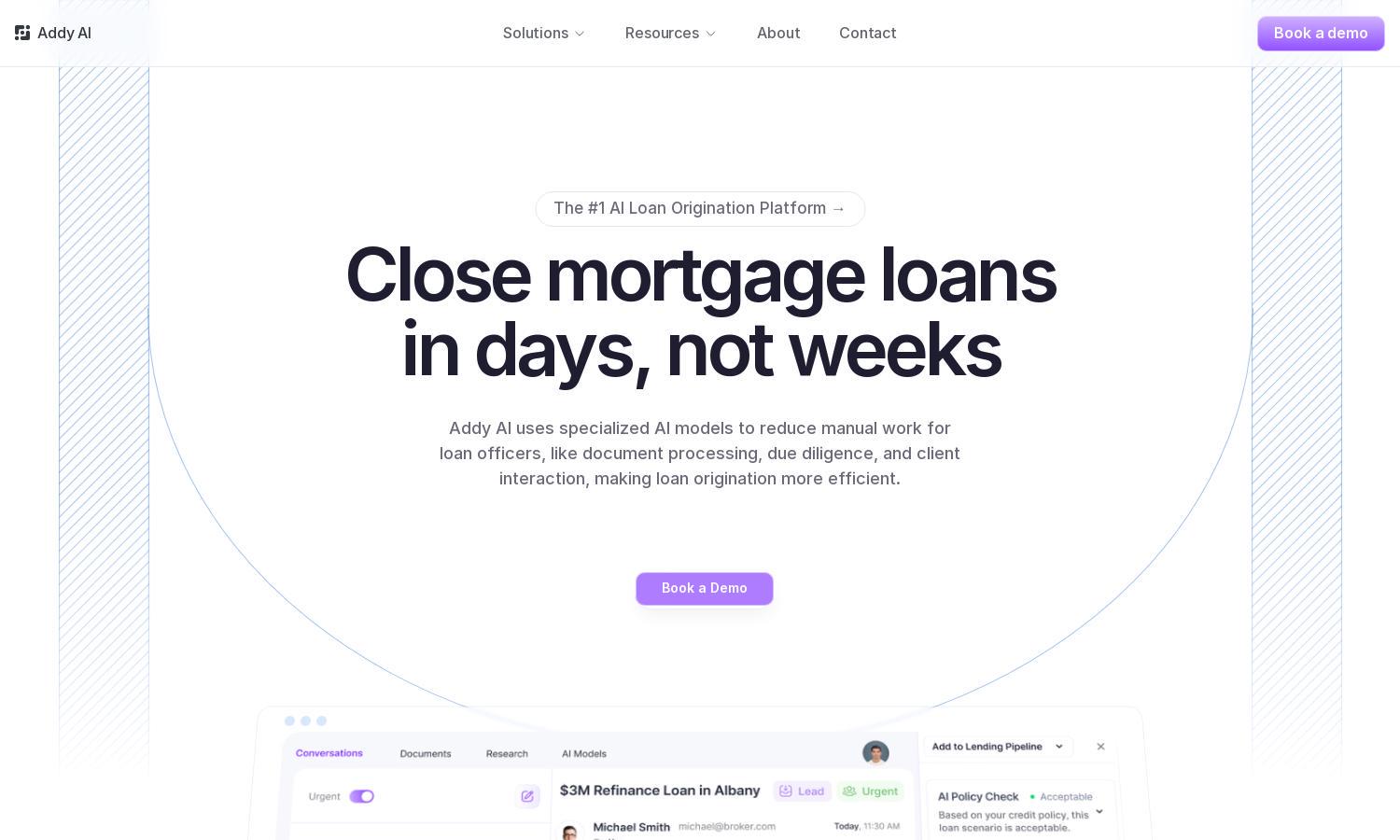

Addy AI

About Addy AI

Addy AI streamlines the loan origination process for mortgage lenders by deploying custom AI models, drastically reducing manual tasks. This innovative platform enhances efficiency, allowing loan officers to save time and close loans much faster. Targeted at lenders and banks, Addy AI improves client satisfaction and operational productivity.

Addy AI offers flexible pricing plans designed to meet diverse needs, ensuring great value. Users can choose from basic to advanced tiers, enhancing their workflows with more features as they upgrade. Discounts may be available for longer-term commitments. Experience the efficiency of Addy AI’s solutions.

Addy AI features a user-friendly interface that promotes a seamless experience. Its layout allows easy navigation through different functionalities, enhancing user engagement and efficiency. Unique aspects like natural language document processing make it stand out, ensuring users can quickly access vital information without hassle.

How Addy AI works

Users start with simple onboarding in Addy AI, where they can train custom AI models tailored to their mortgage lending practices. Once set up, users can easily navigate the platform to automate document processing, client communications, and loan assessments. This unique workflow streamlines processes, allowing loan officers to significantly reduce manual work while boosting productivity.

Key Features for Addy AI

Automated Loan Processing

Addy AI's automated loan processing transforms the mortgage lending experience by drastically reducing the manual workload of loan officers. By utilizing advanced AI technology, it enables a faster, more efficient origination process, ensuring lenders can close loans in days instead of weeks.

Custom AI Model Training

With Addy AI, users can train custom AI models tailored to their specific lending needs. This unique feature allows lenders to automate follow-ups and document processing effectively, significantly streamlining workflows and enhancing client interactions around the clock.

Instant Loan Assessments

Addy AI provides instant loan assessments, quickly checking credit eligibility and offering solutions to improve borrower eligibility. This feature not only speeds up the approval process but also enhances the overall client experience, making it a valuable tool for lenders.

You may also like: